$2 billion+ in loans settled

3,000+ properties financed

98 % approval rate*

📍 Based in Australia, Available Nationwide

60+ lenders & 1,000+ loan products

Since 2016, Absolut Financial has grown from a solo practice to a tight-knit team of seasoned finance professionals—each laser-focused on helping busy doctors secure the right loan, faster and with less stress.

Home Loans for Doctors in Melbourne

We negotiate a special ‘Doctors Only’ rate for you, backed by a 99.6% approval rate.

100% Financing! Pay nothing in LMI.

We cover your annual mortgage home loan fees. You won't find better!

Get up to $3,000 cash back with Best Doctor Home Loans

Rates as low as 4.99%

Save $80,000 On Average With Our Home Loans For Doctors

Borrow up to 100% of your home loan value and pay nothing in LMI.

Enquire About Special Home Loans Offers For Doctors

🔒There is no obligation, we'll get back to you within 5 minutes during business hours.

Enquire About Special Home Loans Offers For Doctors 2025

We Save Doctors Money. Here's The Breakdown.

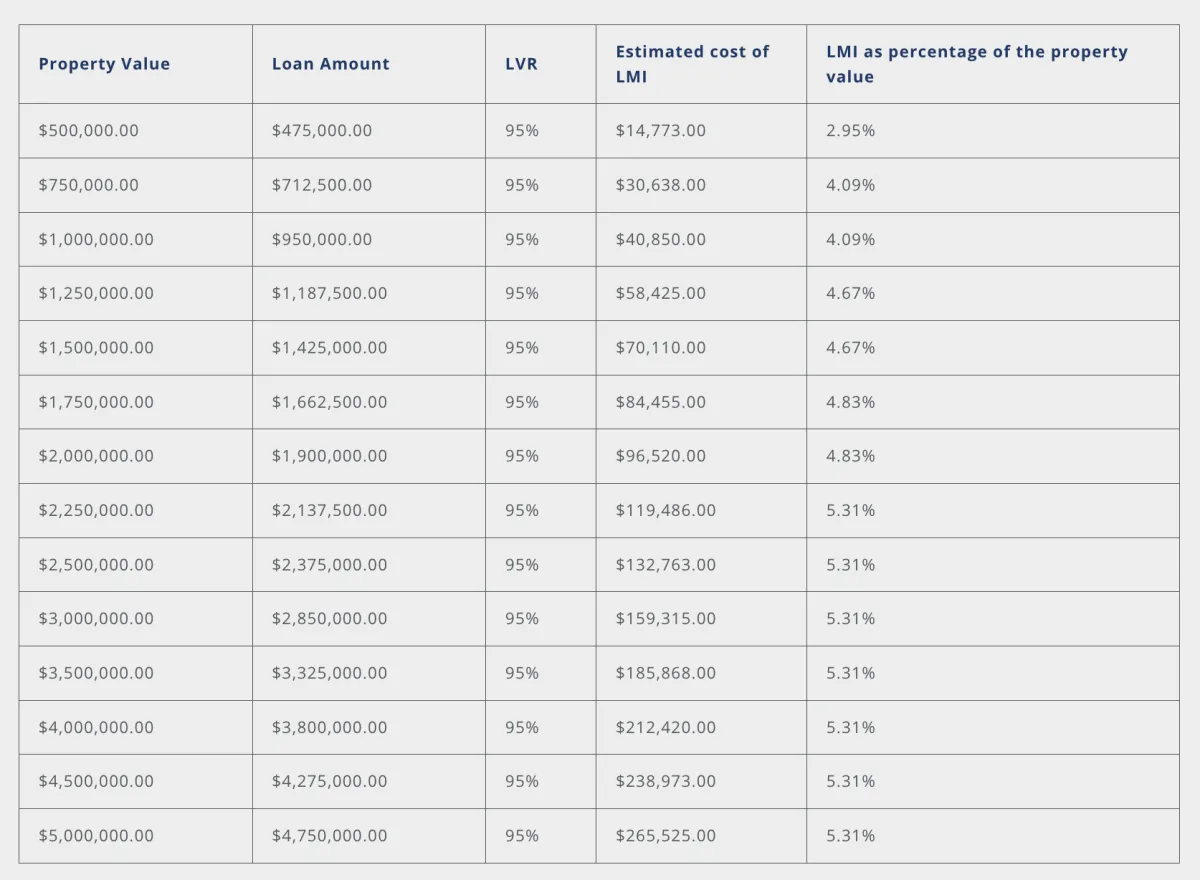

See how much you could be saving from LMI fees.

Enquire About Special Home Loans Offers For Doctors 2025

Top Brokerage Firm in Australia | Absolut Financial

At Absolut Financial, we take a holistic approach to managing our customers financial desires. We are a highly specialised group of finance professionals working tirelessly every day to get the best results for our customers. Since 2016, Absolut Financial has grown from a 1-man band to a team of over 20 finance professionals who have a passion for assisting every day Aussies achieve all their finance & property goals.

We have a goal at Absolut Financial: to make sure that all of our clients are satisfied. That means you’ll get the best possible experience from us, and we won’t rest until your needs are met in an unparalleled way by professionals who care about getting it right for their customers! Our vision statement is simple – to be recognized as the most robust property and financial services company in Australia.

2 billion+ loans settled

98% loan approval

3,000+ properties purchased or financed

400+ 5-star Google reviews

Award Winning Mortgage Brokers

Our Lender Panel

Real Case Studies

Dr David’s Home Loan Case Study

95%LVR waived LMI for doctors

Profile: David is a second-year medical resident doctor based in South West Sydney and earns $140,000 per annum, including overtime.

Objective: He wants to buy his first home, an apartment, for $700,000 so he can be closer to work & stop paying $500 per week in rent.

Problem: While speaking to family, David discovers to his dismay, that his $50,000 in savings is not enough. He will either need to save another $90,000 to make up a 20% deposit, dole out several thousands for LMI or ask his parents to act as guarantors for his home loan to be approved.

Solution: After discussing his situation with a colleague, David is referred to his colleague’s mortgage broker, Mortgage Pros, who specialise in home loans for doctors. There he discovers that a few lenders offer home loans for doctors!

He can borrow over 90 per cent of the property value without paying lenders mortgage insurance and even receives a larger interest rate discount. After crunching the numbers, David is told if he borrows $665,000, 95 per cent of the purchase price, he will save about $25,000 in LMI costs!

Like David, you can save thousands on your home loan with an LMI waiver. You can always contact one of our mortgage brokers specialising in home loans for doctors by calling us on 1300 816 770 or enquiring online.

Dr Jen’s Property Portfolio Case Study

Savings thousands by refinancing

Profile: Jen is a psychiatrist based in the inner west of Sydney. She works for herself and earns $400,000 per year. She has been very successful with property and amassed a portfolio of 7 properties across Australia, roughly half paid off.

Objective: With interest rates rising, Jen has seen her rates go from 2.24% to 5.57% in about a year. She hopes to ensure she is on the lowest rate possible and not paying more than she needs to.

Problem: Jen calls her existing bank and requests them to give her a better interest rate on her home loan. She wants the rates which are advertised on their website. They regret to inform her that they cannot assist as the rates on their website are limited to new bank customers & she is already on the best they can offer.

Solution: After discussing her situation with a work colleague, Jen is referred to her colleague’s mortgage broker, Mortgage Pros, who specialise in home loans for doctors. They thoroughly analyse her situation & the market to find her the best deal. Jen refinanced all her loans and was able to achieve the following:

Lower the interest rates on her loans by 0.50%. Saving her approx. $21,000 per year in interest.

Take advantage of cashback the bank was offering. She was able to obtain a $4,000 cashback per property. Hence as she had 7 properties the bank paid her $28,000 to move her business over.

Re-extend her interest-only periods back to 5 years on her investment loans

Dr Tom’s Home Loan Case Study

How to increase your borrowing capacity

Profile: Tom is a psychiatry registrar based in South Sydney and earns $180,000 per annum including overtime. He is married and has two children. His wife works in graphic design & earns $80,000 per annum. They own a two-bedroom apartment which they live in that is about half paid off.

Objective: Tom & his wife need more space for the kids. They are looking to move into a house with a backyard and are seeking to spend $1,200,000.

Problem: Tom speaks to his existing bank about getting preapproval, and they tell him, to his shock their maximum borrowing capacity for new lending is $800,000. Tom & his wife are not able to save or ask the family for $400,000. In addition, with a budget of $800,000 they are limited to just buying another apartment.

Solution: After researching online, Tom stumbles upon the Mortgage Pros website and sees they specialise in home loans for doctors. He called through and, in under a week, was preapproved to purchase a property for 1.2 mil and only needed to make a few simple changes.

Cancelling all credit cards. Combined, Tom & his wife had three credit cards with a total limit of $20,000. Even though credit cards were seldom used, due to regulations, banks must factor them in as if they were at their limits. This reduced their total borrowing power by approx—$140,000.

Selecting the right bank that will maximise his borrowing capacity. By reverse engineering the methods each of the banks work out their borrowing capacity, we can identify crucial differences in their methods of calculation. By evaluating these differences, we determine which ones may apply to Tom’s situation and then simulate the impact. For his case, we identified the following had the biggest impact on his borrowing capacity:

Using 100% of Tom’s overtime for the most recent three-month period. Most banks only use 80% of overtime; however, even amongst the ones that use 100%, the calculation method varies differently, causing drastic differences in results. For Tom, due to recent pay rises, his overtime income was highest in the last three months which we were able to capitalise on.

Using his salary sacrifice as an untaxed income. Like most PAYG doctors working for a hospital, a portion of Tom’s income went towards salary sacrifice, which would be reimbursed untaxed. Different banks have varying policies on salary sacrifice, with some deducting it from your income to other adding it back as untaxed.

Using the smallest assessment rate buffer on Tom’s existing home loan fixed at 2.19%.

Frequently Asked Questions

Find out how our mortgage specialists can secure the best home loan for you.

How do mortgage brokers add value to doctors getting home loans?

Our brokers work around the clock to deliver white-glove service while hunting down the best deals on the market. Key benefits:

- Waived Lenders Mortgage Insurance (LMI): Eligible doctors may borrow up to 95 % LVR with no LMI (conditions apply—AHPRA registration required).

- Time savings: We compare 60 + lenders and 1,000 + products so you don’t have to spend hours calling banks.

- Exclusive interest-rate discounts & cashback offers available only to medical professionals.

- Tailored loan structures that fit your unique income pattern.

Can doctors borrow 100 % (or more) without a guarantor?

Yes—through a select split-loan structure offered by a few specialist lenders:

- Split 1: 95 % home loan, no LMI.

- Split 2: 5 % + costs via an “exertion loan” (10 – 15 % p.a., 5 – 10 year term, max $500 k).

To qualify you must be AHPRA-registered as a specialist or self-employed for > 2 years. Speak with our senior broker to confirm eligibility.

What doctor income structures will lenders accept?

- Base PAYG salary (full-/part-time): 100 % accepted

- Casual income: 100 % after 3–12 months with employer

- Overtime: 80 – 100 % (bank policy dependent)

- Allowances: Often 80 – 100 % counted

- Locum/ABN invoices: Tax returns, BAS & invoices—some lenders accept ABNs as young as 6 months

- Business income (practice): Typically 2 years returns or alt-doc mix

How much can I save by working with Absolut Financial?

On average our doctor clients save $11,850 in fees and interest over the life of their loan (based on a $500 k loan over 30 years). Exact savings depend on loan size, structure and lender incentives.

Can you negotiate with the Big 4 banks?

Absolutely. We regularly place doctor home loans with CBA, NAB, ANZ and Westpac—often at discounted interest rates and LMI waivers (where criteria are met).

What documents should I prepare?

- Primary ID (passport or driver’s licence) and proof of residence

- Two recent payslips or last two tax returns (self-employed)

- Bank statements showing savings and any existing loan statements

- AHPRA registration details

Can you obtain the lowest rate on the market?

We negotiate across 60 + lenders. Your final rate depends on LVR, income, credit history and loan features, but our specialist status gives us access to exclusive pricing unavailable via retail branches.

How fast will you present loan options?

After you complete our Free Loan Capacity Evaluation and send your documents, we typically deliver tailored lender scenarios within 24 hours.

How do I get started?

Click the button below to complete your Free Loan Capacity Evaluation. Our senior broker will call you, outline your options and there is no cost to you—we’re paid by the selected lender once your loan settles.